Meaning and Comparison of inflation and a Recession

The general strength and stability of an economy are impacted by the two distinct economic phenomena of inflation and recession. The two are contrasted briefly below:

Recession:

Definition of Recession:

- A recession is characterized by a contraction in gross domestic product (GDP) during two or more consecutive quarters and denotes a severe drop in economic activity.

- Causes: A recession may be brought on by a drop in consumer spending, a decline in company investment, a financial crisis, or an external shock to the economy, among other things.

- Effect: Economic output diminishes, unemployment increases, and consumer and corporate confidence fall during a recession. It frequently has a negative impact on stock markets and reduced business profitability.

- Government Response: Governments frequently take fiscal and monetary actions in the wake of recessions to boost economic growth via lowering interest rates, increasing government spending, and enacting tax reductions.

Definition of inflation:

- Inflation is the gradual, sustained rise in the overall level of prices of goods and services that reduces the purchasing power of money.

- Causes: A number of causes, such as an excessive increase in the money supply, rising production costs, increasing demand for goods and services, and external factors like supply chain disruptions, can all contribute to inflation.

- Effect: High inflation reduces the purchasing power of money, raising the cost of goods and services. It can have a negative impact on consumers’ purchasing power, lower the value of savings, and increase economic uncertainty.

- Reaction of the government: Central banks frequently employ monetary policy instruments, such as increasing interest rates, to pricing stability and price inflation. Fiscal policies are another tool that governments can employ to address the root causes of inflation.

In conclusion, while inflation means a prolonged increase in general price levels, which results in a drop in the purchasing power of money, a recession denotes a time of economic decline marked by decreased economic activity and increased unemployment. In order to ensure economic stability and growth, authorities must keep an eye on both recessions and inflation as important economic indicators.

Recognizing Warning Signs or Recession Indicators

A combination of economic measures or indicators known as a recession indicator is what economists and policymakers use to determine if a recession is likely to occur or is already present in a given economy. These indicators assist spot potential indicators of an upcoming economic slowdown and offer insights into the general state and performance of the economy.

Typical signs of a recession include:

- Gross Domestic Product (GDP) Growth: A recession is frequently indicated by a considerable drop in GDP growth or by consecutive quarters of negative GDP growth.

- Unemployment Rate: A higher unemployment rate is a sign of a worsening labor market, which might be a sign of an impending recession.

- Consumer Spending: As a significant engine of economic activity, a drop in consumer spending may be an indication of impending economic trouble.

- corporate Investment: Declining capital expenditures and corporate investments could point to a possible recession in the economy.

- Yield Curve Inversion: A recession may be on the horizon when short-term interest rates exceed long-term interest rates.

- Manufacturing and Industrial Production: A decline in these two sectors of the economy could be a sign of economic slowdown and looming recession.

- Consumer Confidence Index: A decline in consumer confidence may be a sign that people are less optimistic about the direction of the economy.

- Stock Market Performance: A persistent decrease in stock market indices may be a sign that investors are worried about the future of the economy.

It’s crucial to remember that no one indication can foretell a recession with 100 percent accuracy, and economic forecasts are susceptible to a number of complexity and uncertainties.In order to evaluate the state of the economy as a whole and the likelihood of a recession, economists frequently combine various indicators and do in-depth analysis.

Resilient Careers: Jobs That Can Withstand Recessions

Some jobs are regarded as less susceptible to economic downturns during a recession because of their makeup or the sectors to which they belong. Certain professions tend to be more resilient to the effects of a recession, however no career is completely immune. Following are some employment categories that might be less impacted by a recession:

- Healthcare professionals: As long as there is a need for healthcare, professionals in this field, such as doctors, nurses, and other medical personnel, are frequently in high demand.

- Education experts: Since teachers and other educators are generally crucial, educational institutions frequently place a high priority on sustaining their staff.

- Information technology (IT) specialists: As businesses and organizations rely more and more on technology, IT specialists are essential to their smooth operation.

- Utility Workers: Positions involved in supplying

- During a recession, the stability of vital services like telecommunications, water, and power is typical.

- Government workers: Some positions with the government, notably those in the public safety, healthcare, and critical services sectors, may provide more stability during economic downturns.

- Pharmaceutical business: Due to ongoing healthcare demands, employees in the pharmaceutical business, particularly researchers and drug producers, may have reasonably solid work prospects.

- Elderly and Home Caregivers: As the elderly population requires continual care, there is a constant need for caregivers and personal support staff.

- Accountants and Auditors: Despite the current economic climate, businesses and people continue to need financial management and compliance.

- Repair and maintenance services are frequently necessary services, such as those performed by electricians, plumbers, and vehicle mechanics.

- Waste Management and Sanitation: Despite economic downturns, waste collectors and sanitation personnel continue to offer crucial services.

It’s important to remember that, despite the fact that these employment may provide more security during a recession, they may nevertheless provide difficulties and uncertainty depending on the length and type of the recession. During various stages of a recession, economic conditions might alter, and the influence on various job sectors can also change.

GDP and Growth 2024

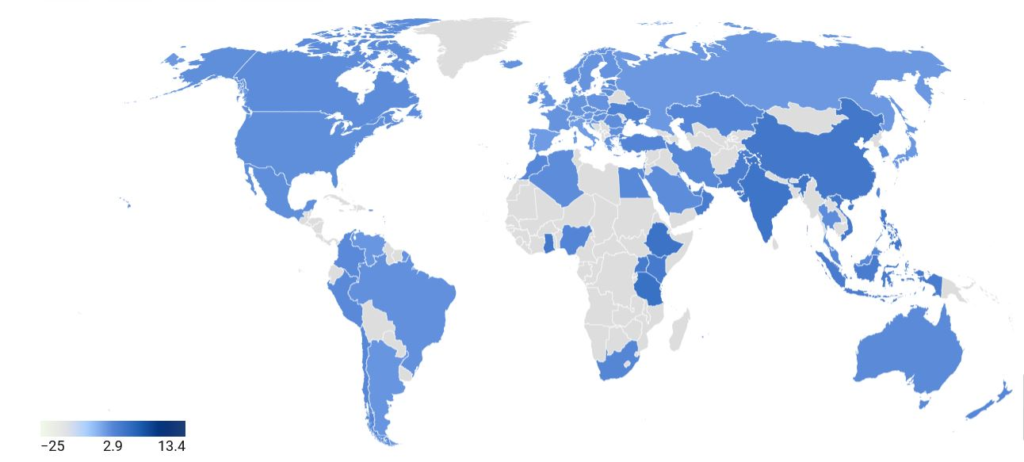

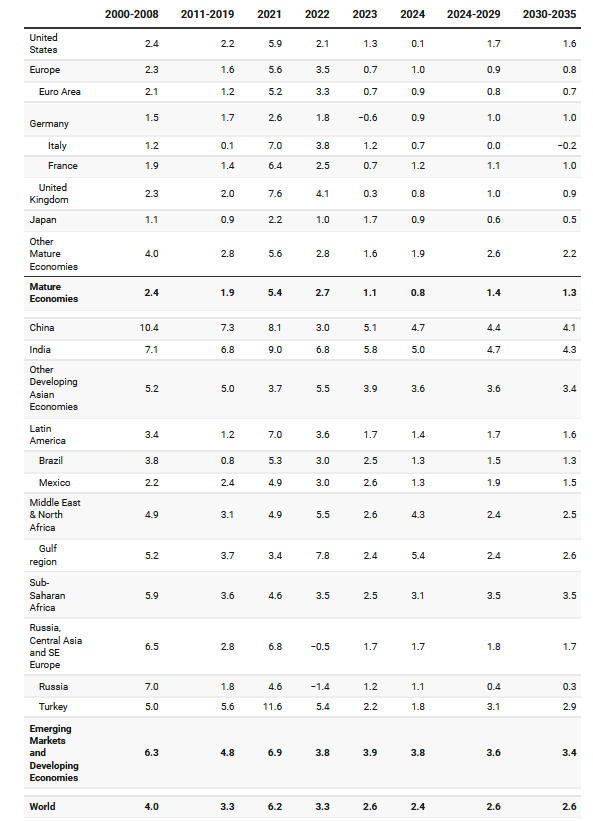

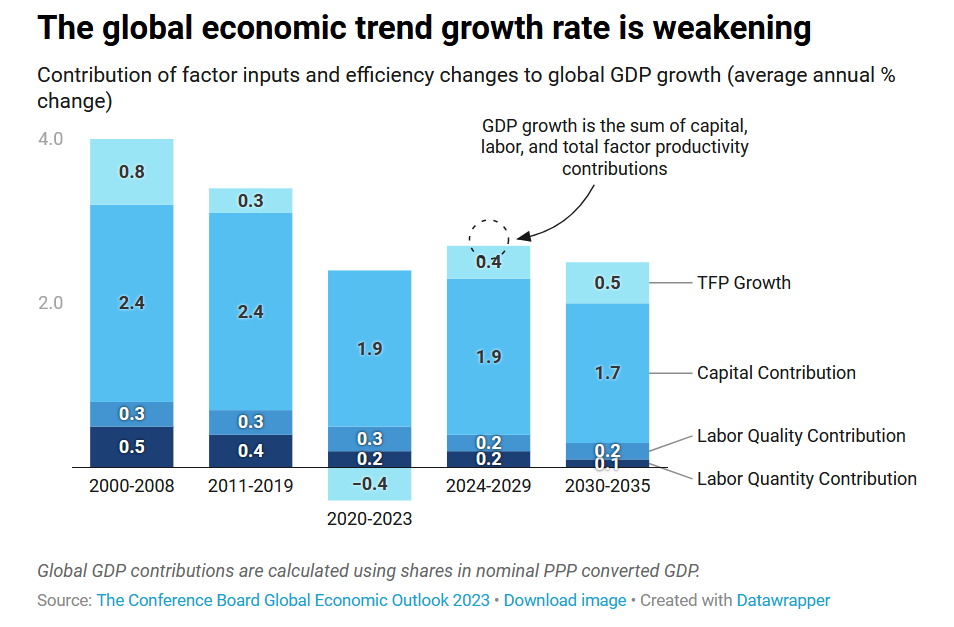

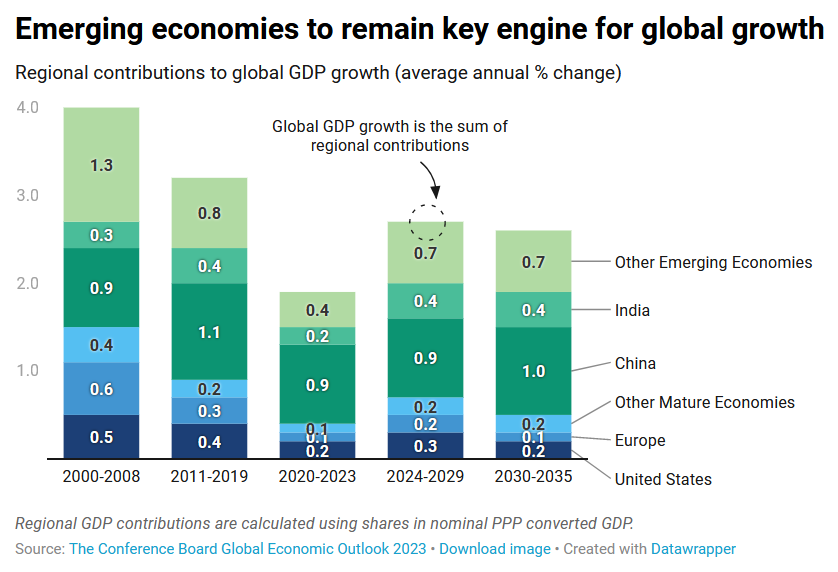

The real GDP growth rate for the entire world is predicted to fall to 2.6% in 2023 from 3.3% in 2022. In 2024, we see a further slowdown to 2.4 percent. Under the pressure of still-high inflation and tightening monetary policy, economic growth is weakening. Instead of a worldwide downturn, we anticipate a rather muted economic outlook. The US and Europe typically experience the slowest growth, whereas rising Asian economies see the fastest growth.

Over the past year or two, monetary policy has been rapidly tightened, which has caused a decline in global housing, bank lending, and the industrial sector. However, strength in other industries has more than made up for this shortfall, especially in the service sector, which is evident in labor markets. robust consumer spending and minimized shock effects

Forecast modifications have been continuing as of late because of how tough it has been to evaluate. However, current data suggest that these encouraging trends may moderate, resulting in a slower rate of global growth in the second half of 2023 and the early months of 2024.

Regarding the prospects for the global economy, two major dangers stand out. Regarding inflation, the first point. While headline inflation has peaked in the majority of economies, core inflation—which excludes volatile goods like food and energy—has been more difficult to predict and hasn’t clearly crested in the majority of economies. The (global) goods and industrial sectors’ price pressures have subsided, and if history is any indication, services prices should follow suit over the coming quarters. The speed of this disinflationary process, however, is difficult to predict and will rely on a variety of factors.

reasons such as declining demand and the pricing power of businesses, the dynamics of the labor market, and the passthrough from earlier input price rises. The stability of the financial markets is the second risk. Rapid monetary policy tightening by central banks exposes flaws in the banking industry and financial markets as a whole. Although the majority of data indicate that global financial markets are relatively stable, longer and more unpredictable lags in the transmission of monetary policy suggest that additional financial instability may be ahead.

Aside from country-specific variations, including a potential US GDP comeback in 2025, businesses would do well to get ready for a future with slower global economic growth. The continued shift to a knowledge-based economy is reflected in the global economy’s relatively moderate growth of roughly 2.5% for 2023–2024.

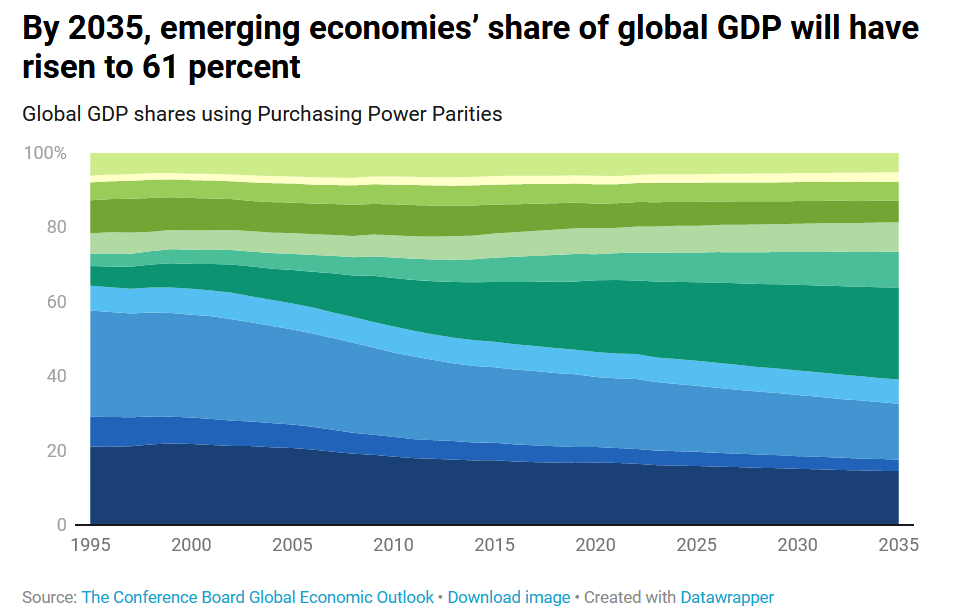

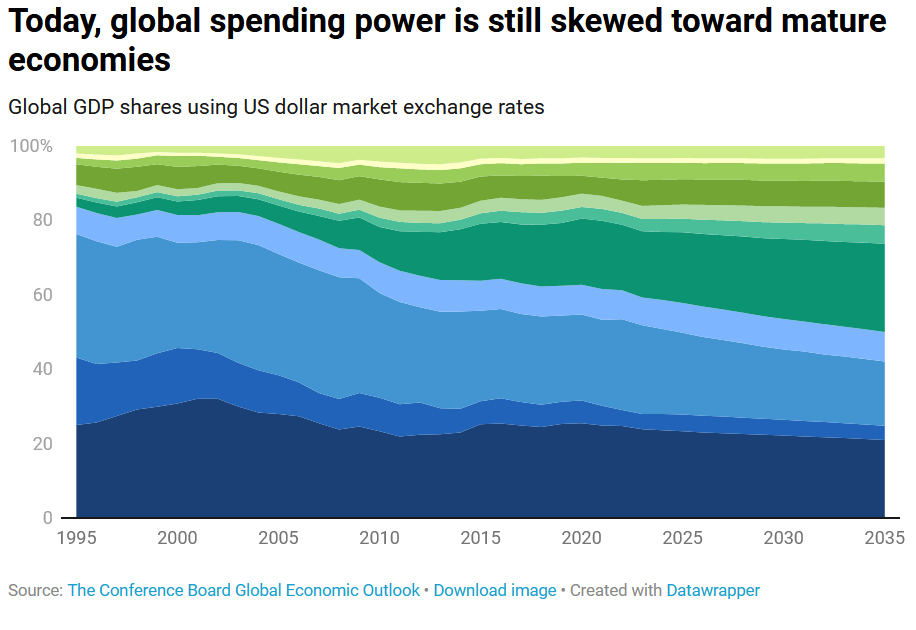

2.6 percent is the predicted worldwide GDP growth rate for the upcoming decade, down from an average yearly pace of 3.3 percent in the decade prior to the pandemic.

The 10-year economic outlook predicts a protracted period of business interruptions and uncertainty, but it also sees opportunities. Over the following ten years, mature markets will contribute less to the global GDP, and global growth will resume its decreasing trend. However, there are still opportunities for businesses to invest in both mature markets—given their wealth and need for innovation to make up for their dwindling labor forces—and emerging markets—given their requirement for both physical and digital infrastructure to support their sizable and youthful labor forces. Long-term growth strategies that work

Develop new business lines, improve corporate culture, embrace automation and digital transformation, find employees with new talents not already existing in the organization, and maximize the hybrid work model when appropriate.

Note: The Conference Board has been using official Chinese GDP data since October 2022, which has caused an upward revision to the global aggregate growth rate. Our previous alternate estimates for China were lower, and as a result, our worldwide aggregate was as well. The decision to stop utilizing official GDP data as our main series for China was taken for a number of reasons, including the inability to track our alternative GDP measure timely due to a lack of up-to-date data and the inability to do extensive analysis without detailed data. Incorporating digital transformation and the essential calculations as outlined in the original approach, as well as biases in official GDP data seeming smaller in earlier years, are some examples. So are creating new business lines, enhancing corporate culture, and embracing digital transformation. We will track alternative GDP numbers for China less frequently, but we will still do so.

Additional Perspectives on the Future of the Global Economy

GDP GROWTH 2024

- Data: The Data Central website provides forecasts and long-term projections.

- Navigating the Economic Storm at the Global Recession Hub (constantly updated).

- Global: StraightTalk®, a quarterly publication on the state of the world economy; the annual long-term prognosis (October 2022)..

- United States: monthly projection; webcasts and report from Monthly Economy Watch; annual long-term outlook (as of November 2022).

- European Union: Monthly projection; Economy Watch report; Long-term outlook for the year (October 2022).

- Annual long-term projection for China: Monthly Economy Watch report (November 2022).

Asia: Long-term prognosis for the year (November 2022). - Quarterly Outlook for the Middle East and North Africa (MENA), April 2023.

- Report from the monthly Emerging Markets Economy Watch.

Chart and Tabels

Regions are aggregated based on nominal GDP in international dollars (PPP converted); For China (Alternative), See Harry Wu, China’s Growth and Productivity Performance Debate Revisited—Accounting for China’s Sources of Growth with a New Data Set, The Conference Board, 2014. The data was updated and revised in April 2022 and the historical data series are available through The Conference Board Total Economy Database.

(JULY 2023) US VIEW

According to the Conference Board, the US economy will experience growing economic weakness over the upcoming months, which will eventually cause a brief, moderate recession. In recent months, consumer expenditure has oscillated between growth and decline. As households struggle with rising rates, inflation, debt repayment, and other variables in the next years, we anticipate that this trend will deteriorate further. The US labor markets are still strong. Even though the degree of tightness is decreasing, we do not anticipate any job losses to occur very soon. While there has been improvement in the area of inflation, more has to be done. We anticipate a 25 bps Fed rate increase in July and possibly another in Q3 2023. No rate reductions are probably not resolved until Q2 2024.

(JULY 2023) UK VIEW

Expanding company activity in the first half of 2023 and increases in consumer confidence indicate that the Euro Area’s economy probably started up in Q2. Inflation fell overall in June once more. On the other hand, core prices went up even more, largely as a result of exceptional circumstances. The ECB is prepared to announce a another 25 basis point increase in interest rates in July as long as underlying price pressures remain at record high levels. Taking everything into account, we maintain our GPD growth projections, predicting the region would expand by a tepid 0.7 percent in 2023 and a modest 0.9 percent pace in 2024.

Data has been collated from https://www.conference-board.org